Benefits Of A USDA Home Loan:

-

No Down Payment Required

-

Closing Costs Can Be Added To Loan Amount Up To The Appraised Value

-

Low Monthly Mortgage Insurance Premium (MI)

-

100% Gifting Permitted

-

Low-Rate Financing

-

No Cash Reserves Requirements

-

No First-Time Homebuyer Requirement

-

6% Seller Contribution Limit

-

Rates, Terms, Eligible Areas, And Income Limits Subject To Change Without Notice.

No Money Down Home Loan

Rural Development Financing

WHO AND WHAT IS RURAL DEVELOPMENT?

(Formerly known as Farmers Home Administration or FmHA)

USDA (United States Department of Agriculture) has the unique responsibility of Coordinating Federal assistance to rural areas of the Nation. The Rural Development mission is to help rural Americans improve the quality of their lives, one of which is the financing of safe, decent, affordable housing. A new and sharper focus on rural development took shape with passage of the Department of Agriculture Reorganization Act of 1994.

One of the new Rural Development organizations reporting to the Under Secretary for Rural Development is the Rural Housing Service (RHS) whose responsibility includes rural housing programs.

HOW MUCH MONEY WILL I NEED FOR A DOWN PAYMENT?

A down payment is NOT required.

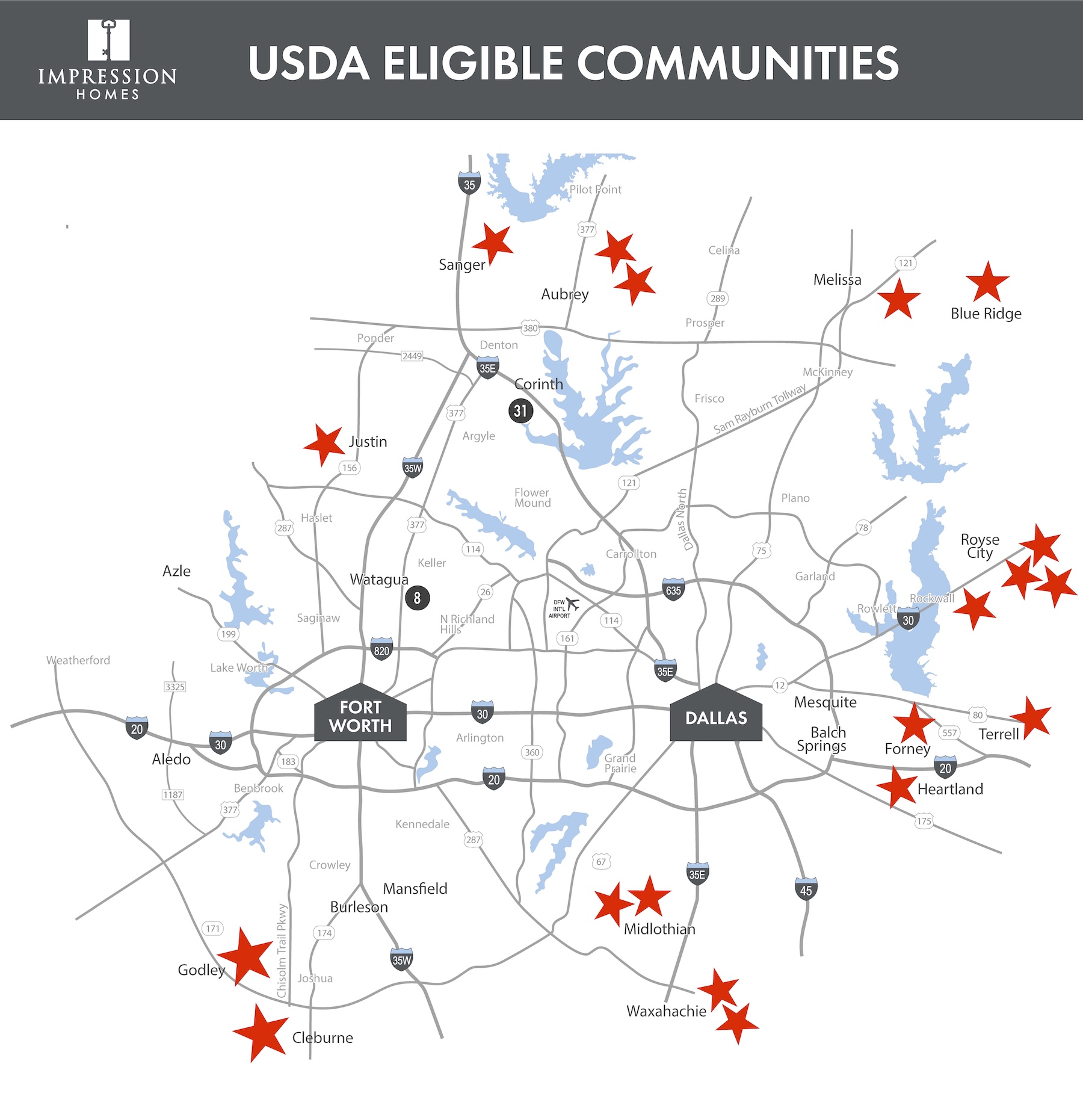

THE HOME DOES NOT HAVE TO BE IN "THE COUNTRY".

The home may be located inside the city limits of selected communities of generally less than 10,000 population and in some cases up to 25,000 population are eligible for RD financing. Call us or your local RD office for eligible areas and cities.

IS THIS FIXED RATE FINANCING?

YES! RD does not offer or allow adjustable rate mortgages. The 502 Guaranteed Rural Housing Loan is fixed rate for 30 years.

WHAT KIND OF HOME CAN I BUY?

New and Existing homes are eligible! There is no restriction as to design or size of the home as long as the home is determined to be SAFE, SOUND and SANITARY and meet RD energy efficiency standards. However, homes with in-ground swimming pools are not eligible.